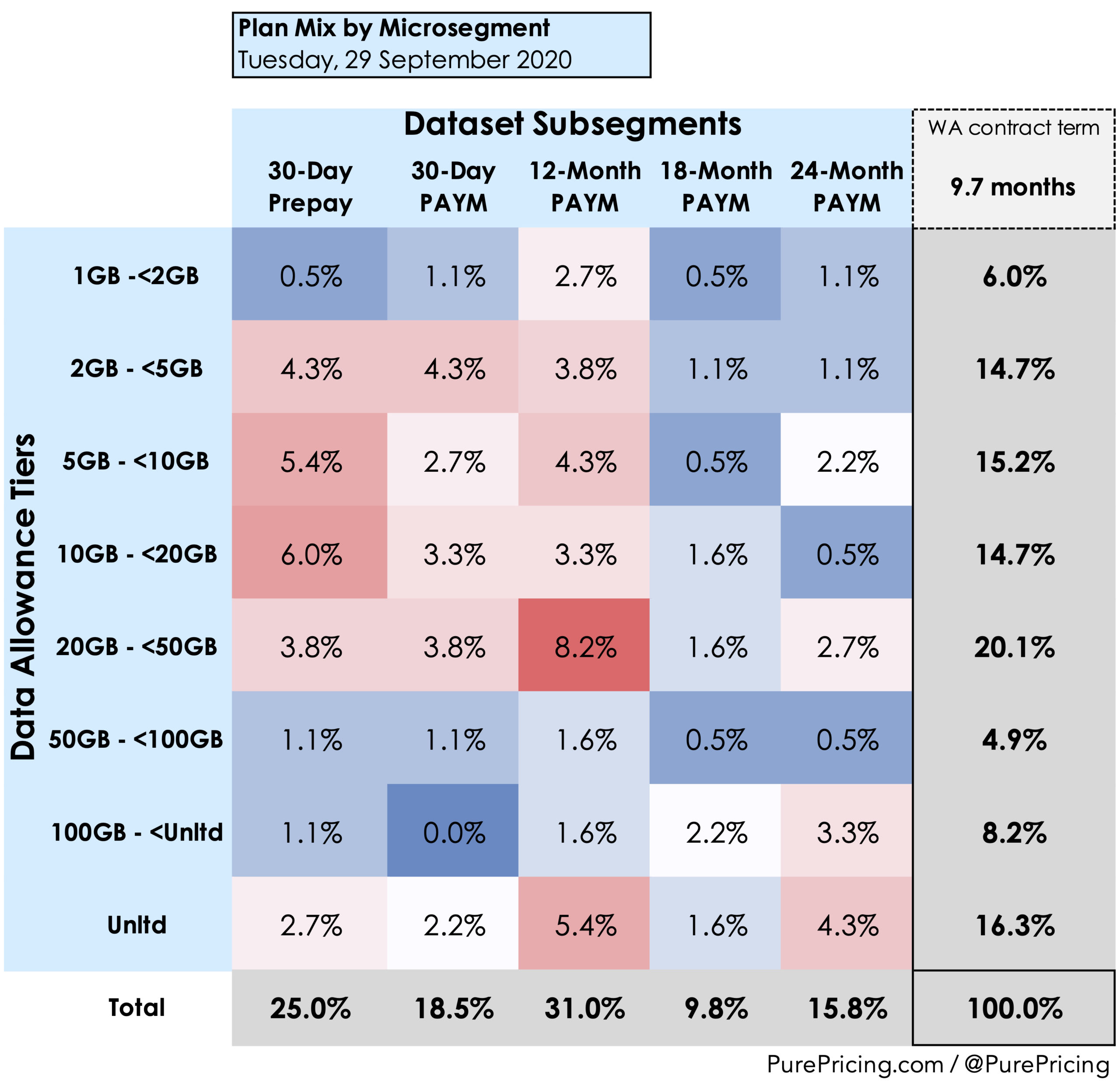

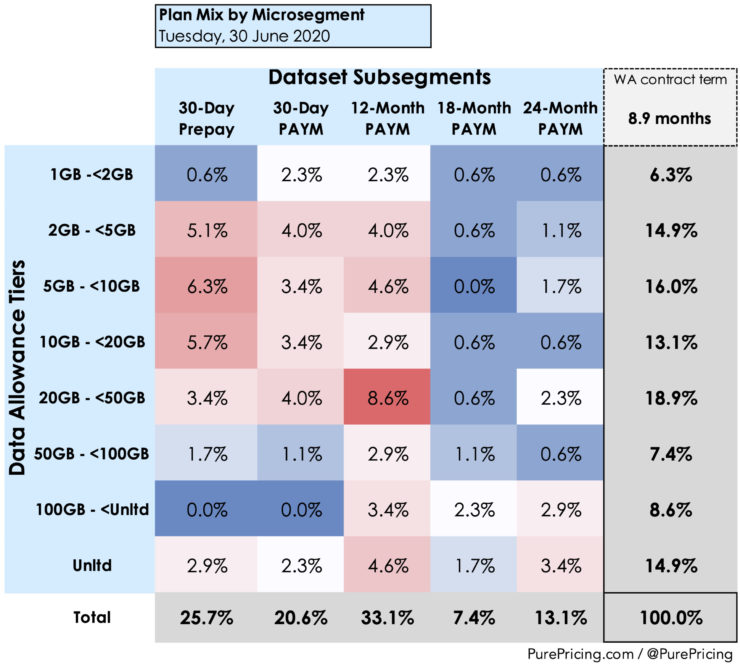

Virgin Media O2’s Volt proposition: Getting serious about fixed mobile convergence

Virgin Media O2’s (VMO2) Volt proposition makes a big impact from a simple idea. If you want people to do something, you’ve got to step forward and ask them to do it. (continued)