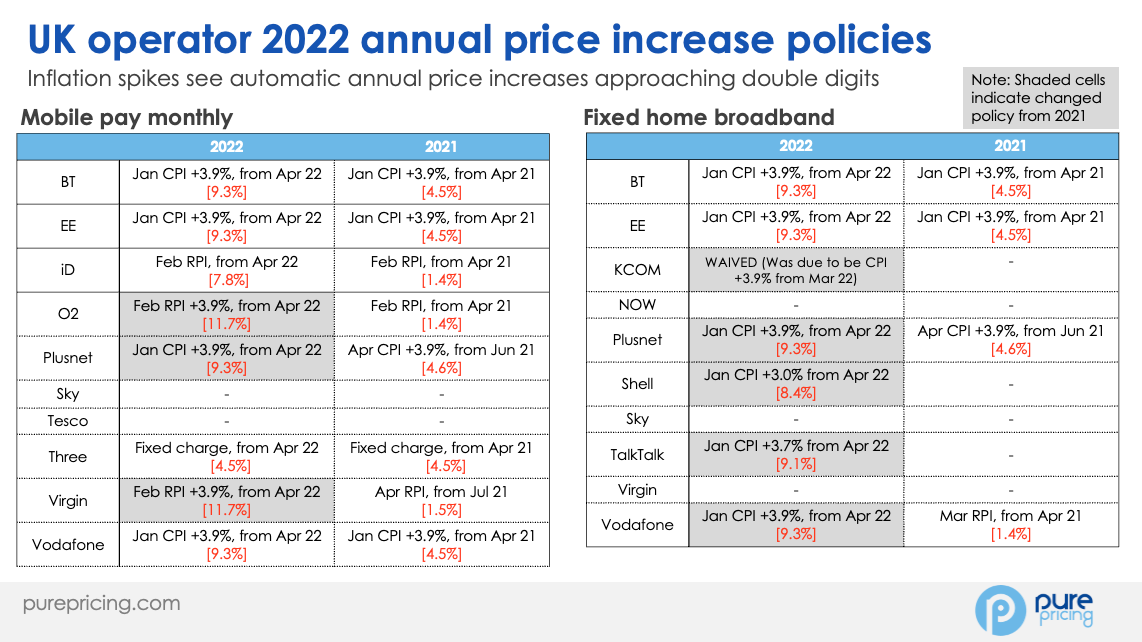

2022 is shaping up to be a bumper year for telco operator revenue performance. Spikes in inflation means higher prices thanks to operator’s automatic annual price increase mechanisms.

Households will see double digit annual price rises in O2 and Virgin Mobile pay monthly plans (11.7%), and near double digit increases (9.3%) from BT brands BT, EE and Plusnet across mobile pay monthly and home broadband plans. Similar price increases are being deployed by competitors.

Automatic annual price increases linked to RPI, or CPI inflation metrics were introduced by mobile pay monthly operators in the 2010’s. This pricing lever is being copied by fixed broadband operators in the 2020’s. BT/EE turbocharged inflation linked annual price increases in 2021 by introducing a “CPI + 3.9%” mechanism. This guaranteed BT/EE above-inflation automatic price rises each year of 3.9%, plus inflation. “Inflation plus” automatic annual price increase mechanisms were soon copied by BT/EE’s rivals.

Adding a 3.9% to the inflation metric may have seemed harmless in 2021 with inflation rates below 1%. BT / EE’s total annual price increase for 2021 was 4.5%, which included the 3.9% fixed component. Then January 2022’s inflation rate spiked to 5.5% (CPI) and 7.8% (RPI), pushing UK inflation to 30-year highs. BT / EE’s annual price increase jumps to 9.3% in 2022, from 4.5% in 2021. Virgin Media O2 pay monthly customers saw a jump in plan prices of 11.7% in 2022 from 1.4% (O2) and 1.5% (Virgin Mobile) in 2021.

At face value level, annual price increases above inflation are bad news for consumers. UK households will already be experiencing a cost-of-living hit in 2022 due to price rises in energy, food, clothing and other household goods and services. Also, EU roaming charges return on most mobile pay monthly plans creating further telecoms cost burdens on households.

Operators justify these increases by pointing to the exponential growth in data traffic running across their mobile and fixed networks. To cope with increased demand for more traffic, better speeds, and wider coverage, operators turned to annual price increases as a revenue source to fund network investment. Indeed, there is a clear case that capital intensive expansion of 4G and 5G coverage and full fibre broadband to the home will need investment from operators that must be funded.

We would argue that, although unwelcome, there are real consumer benefits created from operators moving to automatic annual price increase mechanisms.

Telco consumers have long been victims of “gotcha” pricing tactics deployed by operators to fund revenue grabs. These revenue grabs often were needed to offset revenue losses from competition driven declines in headline pricing.

For mobile pay monthly segment, out-of-allowance charges for non-standard call types, international calls, and roaming calls resulted in a bill that was often very different to the monthly fee the customer thought they had signed up to with their pricing plan. The result was regular bill shock and confusion for consumers in understanding the true price of their services.

For broadband customers, huge jumps in monthly plan fees would occur once a customer had left their contracted promotional price period. Again, the monthly bill became a source of uncertainty, as the customer had to monitor whether they were charged the in-contract or out-of-contract price.

A combination of regulatory pressure from Ofcom and customer satisfaction feedback has forced operators away from these legacy pricing practices. Annual automatic price increases may be unwelcome, but they are a fairer and more transparent way of increasing revenue than the pricing tactics operators turned to in the past.

Customers need their monthly bill payments to be stable, predictable, and more easily comparable with plans from competing operators. Operators need extra revenue to fund network investment. Automatic annual price increases are a necessary reality for the UK market.