Headlines

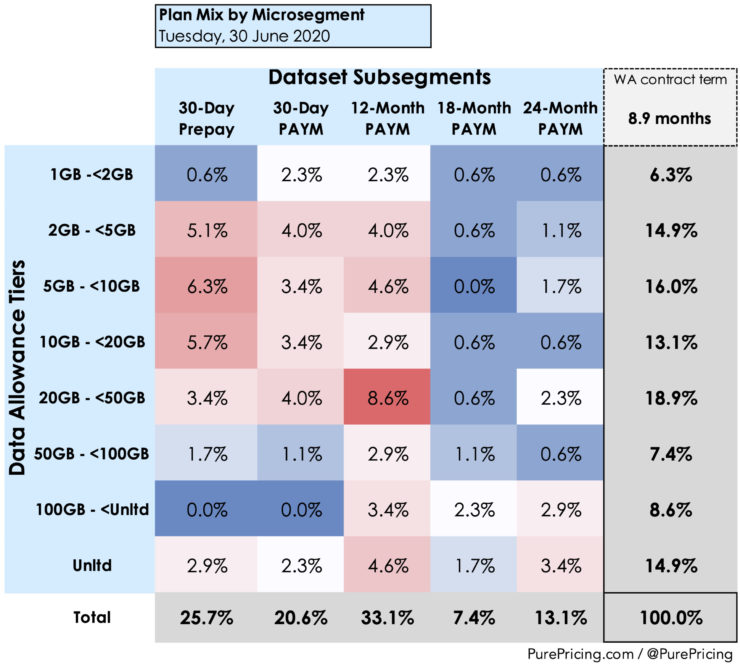

- Tipping point reached as >50% of the Pure Pricing dataset sim-only phone plans require commitment of 12 months or more. The combination of 30-Day PAYM and 30-Day Prepay is now the minority of dataset plans.

- Weighted average contract term of dataset plans grows to 8.9 months (+8.9% QoQ).

- Average plan price remains flat at £18.76 (-0.9% QoQ).

- Average plan allowance remains flat, 30.9% of dataset plans offer 50GB+ (+0.7% QoQ). We are not seeing evidence of operators raising data allowances to meet increased customer demand due to the introduction of 5G into the market so far.

- 12-Month PAYM offering 20-49GB remains the dataset hotspot, capturing 8.6% of plans on offer.

- 12-Month PAYM remains the largest subsegment at 33.1% of the dataset. 20-49GB remains the most offered allowance tier, at 18.9% of dataset plans.

- Virgin entered the 24-Month PAYM subsegment in April, BT Mobile entered the 18-Month PAYM subsegment in May. BT’s decision means its BT Mobile and EE brands both compete in the 18-Month PAYM subsegment.

Background

Each quarter Pure Pricing interrogates its phone sim-only dataset to analyse how the UK phone sim-only market is evolving over time. This review will look at calendar Q2 2020 with market data as at Tuesday, 30 June 2020.

We have 175 phone sim-only plans tracked in the Pure Pricing dataset as at the 30 June 2020 snapshot, versus 166 plans in the Q1 dataset snapshot as at 31 March 2020.

Plans are split amongst 5 market subsegments (30-Day Prepay, 30-Day PAYM, 12-Month PAYM, 18-Month PAYM, 24-Month PAYM) and 8 data tiers (2GB+, 5GB+, 10GB+, 20GB+, 50GB+, 100GB+, unlimited) producing a map of 40 microsegments in which operators and price plans compete.

Operator brands tracked in the dataset include the MNOs, MNO sub-brands and major MVNOs.

Pure Pricing’s sim-only dataset tracks plans offered for sale by operators, not plans purchased by customers.

For detailed information on our phone sim-only dataset methodology, please see the note at the end of the post.

Let’s get started by reviewing the major tariff developments over the quarter.

Recap of Key Pricing Developments

- April

- EE retired “Smart SIM” 4G plans. Under the new pricing, its unlimited 5G plan was positioned at a £5 premium to its unlimited 4G plan. The unlimited 5G plan also included three “Swappable” content benefits.

- O2 launched a prepay bundle promotion: 5X data on its £10 and £15 bundles for three months.

- Three introduced a 12-month sub-£10 sim-only plan.

- May:

- O2 refreshed sim-only plans. Strongest deals now require an 18-month contract, previously 12-month versions were available. 100GB for £20 per month (18-month contract) is the hero plan.

- Virgin Mobile launched new 12-month promotional plans targeting the £10 to £15 segment, including £10 for 10GB and £13 for 36 GB.

- BT Mobile doubled data on most 12-month plans e.g. £15 for 40GB (was 20GB) for BT Broadband customers. It has also added some new 18-month plans where previously it had no 18-month offer.

- EE introduced 3 months half price promotions on selected tariffs – the first time it has used this type of promotional mechanism for sim-only in recent years.

- June:

- EE refreshed its sim-only plans, bringing a more transparent pricing structure. Two tiers of plans introduced – Essential and Smart. Essential plans offered 12-month contracts and speeds of up to 60Mbps, with a maximum data allowance of 40GB. Smart Plans came with 18-month contracts, Reserve Data, 5G Ready and included 1 Swappable. Smart plans also offered data allowances from 60GB to unlimited data. Britbox was introduced as a Swappable option.

- O2 reduced the price of its 100GB 12-month sim-only plan from £25 to £20 per month, to create a new hero plan. O2 also introduced a strong 18-month plan which gives 25GB for £15 per month and included roaming in additional non-EU countries.

- iD refreshed its 30-day pay monthly plans, giving lower pricing or more value across data tiers, e.g. £8 for 5GB (was 3GB) and £20 for unlimited data (was 50GB).

- EE launched summer promotion for prepay bundles giving extra data for up to 3 months on £10 and £20 bundles.

Q2 2020 Sim-only Analysis

Let’s get started by looking at phone sim-only subsegment participation by operator brand.

Q2 2020 Phone sim-only plan subsegment participation by brand

The key developments in participation this quarter were:

- April: Virgin entered the 24-Month PAYM subsegment

- May: BT’s BT Mobile brand entered the 18-Month PAYM subsegment in May. BT’s decision to place the BT Mobile brand into the 18-Month PAYM market is noteworthy, as its EE brand was already operating in this subsegment.

Turning now to plan distribution by subsegment.

Q2 2020 Phone sim-only plan distribution by subsegment:

- 30-Day Prepay: ⬇️ 25.7% (vs 27.7% Q1 2020, -2.0 pp)

- 30-Day PAYM: ⬇️ 20.6% (vs 22.3% Q1 2020, -1.7 pp)

- 12-Month PAYM: ➡️ 33.1% (vs 32.5% Q1 2020, +0.6 pp)

- 18-Month PAYM: ➡️ 7.4%** (vs 6.6% Q1 2020, +0.8 pp)

- 24-Month PAYM: ⬆️ 13.1% (vs 10.8% Q1 2020, +2.3 pp)

- 12-Months+ share of dataset plans: ⬆️ 53.7% (vs 50.0% Q1 2020, +3.7 pp)

- 18-Months+ share of dataset plans: ⬆️ 20.6% (vs 17.5% Q1 2020, +3.1 pp)

- Weighted average contract term of dataset plans: ⬆️ 8.9 months (vs 8.2 months in Q1 2020, +0.7 months, +8.9%).

Last quarter the dataset hit a tipping point in terms of contract duration. In Q1 2020, 50% of sim-only plans in the dataset required a 12-Month commitment or longer. This trend continues into Q2 2020, now 53.7% of dataset plans are 12-Month commitment or longer. The combination of 30-Day Prepay and 30-Day PAYM plans now represent the minority of the dataset.

24-Month PAYM plans were the fastest growing subsegment of the dataset in Q2 2020, increasing to 13.1% of the dataset in Q2 2020, up 2.3 pp from Q1 2020. For comparison, 24-Month PAYM plans comprised only 4.7% of the dataset in Q4 2019.

Let’s turn to average plan price per subsegment.

2020 Phone sim-only average plan price by subsegment:

- 30-Day Prepay: ➡️ £17.31 (vs £17.30 Q1 2020, +0.0%)

- 30-Day PAYM: ➡️ £18.44 (vs £18.41 Q1 2020, +0.2%)

- 12-Month PAYM:⬇️ £19.12 (vs £19.44 Q1 2020, -1.6%)

- 18-Month PAYM: ➡️ £20.77 (vs £20.82 Q1 2020, -0.2%)

- 24-Month PAYM: ⬇️ £20.08 (vs £21.49 Q1 2020, -6.6%)

- Average across all plans: ➡️ £18.76 (vs £18.93 Q1 2020, -0.9%)

Average plan prices per subsegment of the dataset were flat across the board, with the exception of 24-Month PAYM subsegment which saw an average price change of -6.6%. As this subsegment grows, competitive pressure appears to be placing downward pressure on pricing.

Let’s looks at plan distribution by data allowance.

Q2 2020 Phone sim-only plan distribution by data allowance:

- 1GB – <2GB: ➡️ 6.3% (vs 7.2% Q1 2020, -0.9 pp)

- 2GB – <5GB: ⬇️ 14.9% (vs 16.9% Q1 2020, -2.0 pp)

- 5GB – <10GB: ⬆️ 16.0% (vs 14.5% Q1 2020, +1.5 pp)

- 10GB – <20GB: ➡️ 13.1% (vs 13.3% Q1 2020, -0.1 pp)

- 20GB – <50GB:➡️ 18.9% (vs 18.1% Q1 2020, +0.8 pp)

- 50GB – <100GB: ➡️ 7.4% (vs 7.8% Q1 2020, -0.4 pp)

- 100GB – < Unlimited GB: ⬆️ 8.6% (vs 6.0% Q1 2020, +2.5 pp)

- Unlimited GB: ➡️ 14.9% (vs 16.3% Q1 2020, -1.3 pp)

- Plans 50GB+: ➡️ 30.9% (vs 30.1% Q1 2020, +0.7 pp)

The key takeaway here is that data allowance growth, as measured by the proportion of dataset plans offering 50GB+, remains flat at 30.9%. This is an increase of just +0.7 pp from Q1 2020.

Based on operators’ plan offerings this quarter we are not seeing evidence of significantly increased customer data demand. This suggests the introduction of 5G into the market is not yet having material impact.

Another useful way to examine the market is to combine the contract length subsegments with the data allowance bands to produce a heat map of the the 40 microsegments in the dataset.

Q2 2020 Phone sim-only plan microsegment heat map

12-Month PAYM plans with 20-50 GB data allowance remain the “hotspot” in the dataset, capturing 8.6% of all dataset plans. 12-Month PAYM is the most popular subsegment at 33.1% of dataset plans, while 20GB-49GB remains the most offered data allowance tier at 18.9% of the dataset.

Turning now to operator targeting of the 40 microsegments, we can examine a table of the lowest price brand(s) per microsegment to gain insight as to which microsegments each operator brand is focusing its competitive efforts.

Q2 2020 Phone sim-only lowest priced plan per microsegment

Examining each of the subsegments in turn:

Q2 2020 Phone sim-only 30-day prepay lowest priced plan

Three continues to deploy its SMARTY sub-brand as a price leader to drive acquisition. Low pricing allows SMARTY to build a prepay base that can be used to drive upsell to the main Three brand pay-monthly base. Note SMARTY has repriced its unlimited data plan to £18 (was £20), pushing an unlimited data plan below the £20 price-point.

Q2 2020 Phone sim-only 30-day pay-monthly lowest priced plan

iD Mobile continues to dominate price leadership in this subsegment. ID has increased prices for its plans in the 20GB+ tier (now £15, was £14) and 50GB+ tier (now £18, was £16) in Q2 without sacrificing price leadership. This suggests earlier pricing was too aggressive.

Q2 2020 Phone sim-only 12-month pay-monthly lowest priced plan

This subsegment remains the most competitive, featuring 1/3 of all dataset plans. All data allowance bands with the exception of unlimited data saw changes to the lowest priced plan. BT continues to compete aggressively via its BT Mobile brand as a mobile cross-sell to its broadband customers. O2 retain a strong focus on its hero £20 / 100GB plan with 6 months inclusive Disney+ and inclusive roaming for a number of non-EU international destinations.

Q2 2020 Phone sim-only 18-month pay-monthly lowest priced plan

Despite this subsegment being the smallest (7.4% of the market), it remains an area of competitive interest. May saw the BT Mobile brand enter the subsegment, with exclusive plans for its standard broadband base, and additional exclusive plans for its Halo premium converged customers. BT’s tactics in this subsegment are not clear, as the BT Mobile offerings compete against its EE brand, which has a long standing presence in this subsegment.

Q2 2020 Phone sim-only 24-month pay-monthly lowest priced plan

Virgin has been very active in the fastest growing subsegment since its April entry. Virgin aggressively priced plans across data allowances 1GB+ to 20GB+ to secure clear price leadership, creating a strong presence in the subsegment.

Key findings of Q2 2020 Phone Sim-Only Review

- Longer contracts are increasingly common: Operators have been increasing shifting focus away from 30-Day plans, to the extent that plans requiring commitments of 12-Months and above are now the majority of the market.

- The rise and rise of 24-Month PAYM: A key driver of the market shift to longer contracts is the growth of the 24-Month PAYM subsegment. 24-Month PAYM plans were the fastest growing market subsegment in Q2 2020, increasing to 13.1% of the market in Q2 2020, up 2.3 pp from Q1 2020. For comparison, 24-Month PAYM plans comprised only 4.7% of the market in Q4 2019. Virgin chose to enter this subsegment in April, adding to subsegment growth and competition.

- Pricing and allowance levels broadly flat: Despite shifts in subsegment weightings, overall market pricing and allowance levels remain stable. We expect to see shifts in both in the second half of the year as 5G plans and devices begin to capture a more meaningful share of the market.

For questions or follow-up, you can reach us at hello@purepricing.com or on Twitter @PurePricing

Appendix (Dataset Methodology):

Each week Pure Pricing collects sim-only plan data for the following operators:

BT (plans available to broadband customers), BT (plans available to Halo customers), Plusnet (plans available to broadband customers), EE, iD, O2, giffgaff, Tesco Mobile, Sky, Three, SMARTY, Virgin, Vodafone and VOXI. Standalone SIMO plans from BT and Plusnet that don’t require customers to already have a broadband service from these operators have been excluded. Voice centric phone sim-only plans of less than 1GB allowance are excluded from the data set. Vodafone unlimited plans with speed restrictions of less than 2Mbps are excluded.

QoQ percentage changes are marked as ➡️ flat unless QoQ movement is ≥1 percentage point (pp) positive or negative.

Additional BT notes:

- BT (+BB) = Phone sim-only plans available to standard BT broadband customers

- BT (+Halo BB) = Phone sim-only plans available to BT “Halo” premium converged broadband customers

- BT (EE) = Phone sim-only plans offered by BT’s EE brand

- BT (Plusnet +BB) = Plusnet brand phone sim-only plans available to Plusnet broadband customers