Key Observations From Q3 2020

- Operators continue to stretch sim-only plan contract commitments: Last quarter saw the Pure Pricing sim-only dataset reach a tipping point with over half of all plans requiring a commitment of 12-months or more. Q3 2020 ends with a new milestone – over a quarter (25.5%) of dataset plans now require a commitment of 18-months or longer. The average contract term of dataset plans continues to increase, and now sits at 9.7 months.

- Pricing overall slightly down, but remains particularly aggressive in 30-day subsegments: Average plan price across the dataset remains relatively stable at £18.51, a -1.4% decrease in Q3 2020 versus the previous quarter. However Three’s SMARTY sub-brand continues to price aggressively in the 30-day prepay subsegment, offering the lowest price across any contract length for 20GB+, 50GB+, and 100GB+ data tiers. iD remains aggressive in the 30-day PAYM subsegment, including offering the lowest priced unlimited data plan in the dataset at £18 per month.

- No 5G effect in data allowances observed so far: Despite 5G-ready plans increasing their presence in the dataset, there is no evidence of a matching increase in data allowance to reflect expected increases in customer demand for 5G data. Data allowance growth is down slightly, with 29.3% of dataset plans offering 50GB+ data allowances (-1.5 pp QoQ).

Background

Each quarter Pure Pricing interrogates its phone sim-only dataset to analyse how the UK phone sim-only market is evolving over time. This review will look at calendar Q3 2020 with market data as at Tuesday, 29th September 2020.

For the Q3 2020 review, we have 184 phone sim-only plans offered by 13 MNO / MVNO brands tracked in the Pure Pricing dataset as at the Q3 closing snapshot as at 29th September 2020. For comparison, our closing Q2 2020 snapshot as at 30th June 2020 contained 175 plans.

Plans are split amongst 5 market subsegments (30-Day Prepay, 30-Day PAYM, 12-Month PAYM, 18-Month PAYM, 24-Month PAYM) and 8 data tiers (1GB+, 2GB+, 5GB+, 10GB+, 20GB+, 50GB+, 100GB+, unlimited), producing a map of 40 microsegments in which operators and price plans compete.

Operator brands tracked in the dataset include the MNOs, MNO sub-brands and major MVNOs.

For detailed information on our phone sim-only dataset methodology, please see the note at the end of the post.

Let’s get started by reviewing the major tariff developments over the quarter.

Recap of Key Pricing Developments

- July

- Vodafone and Three launched summer pre-pay offers, following on from EE’s summer pre-pay offer which launched in June. Vodafone’s promotion was very similar to EE’s, giving additional data for up to 3 months. Three offered a more targeted and rich offer: 100GB for £20 for up to 6 months, which was subject to customer electing auto-renewal.

- O2 launched a new 18-month plan giving 120GB for £20. O2 also refreshed its prepay bundles, significantly increasing data value.

- Three revisited a promotion of 6 months-half price on its 12-month Unlimited data plan.

- O2 refreshed its prepay bundles, significantly increasing data value.

- Vodafone expanded its range of subscription content services available for bundling with premium pay-monthly contracts. Amazon Prime and YouTube Premium were two new content services offered alongside existing services Sky Sports Mobile TV, Spotify Premium and NOW TV.

- Tesco increased data value in its 30-day Rocket Packs e.g. with Auto-renew, £10 for 8GB (was 5GB), £15 for 20GB (was 10GB) and £20 for 40GB (was 20GB).

- August

- EE, Vodafone and O2 launched new 18-month and 24-month offers. EE and Vodafone introduced 24-month plans costing £20 giving 80GB and 100GB respectively. O2 offered its 18-month Unlimited data plan for £15 for the first 3 months and £30 thereafter.

- O2 refreshed its 12-month promotions, with two strong offers – £15 for 15GB and £17 for 30GB.

- iD, Plusnet and Vodafone refreshed 30-day pay-monthly plans. iD introduced particularly strong offers at the £15 and £20 price points, offering 100GB and unlimited data respectively, whilst Plusnet offered its broadband base 10GB for under £10 per month. Vodafone increased the prices of all its 30-day sim-only plans by £4 per month.

- Smarty offered double data on its £15 pre-pay bundle, giving 100GB for 12 months (usually 50GB).

- September

- giffgaff offered 50% additional data on a recurring pre-pay bundle. The offer was 9GB, instead of 6GB, on its £10 pre-pay bundle in return for customers setting up a recurring payment.

- Vodafone offered 6 months half price on 24-month unlimited plans.

- Virgin and iD launched promotions on unlimited data offering lowest recorded prices for unlimited data. iD offered unlimited data at £18 per month on a 30-day pay-monthly contract, a reduction of £2 on its previous offer. Virgin offered its TV and Broadband customers unlimited data for £20 per month with a 24-month contract, or £23 per month with a 12-month contract.

- Tesco re-introduced 18-month contracts, giving 50% additional data to the 12-month plan equivalents, plus a £2 discount on its Unlimited data plan vis a vis the 12-month equivalent.

- EE, BT and Voxi adjusted 5G availability. 5G once again became available with EE Smart sim-only plans. EE also offered two 12-month plans enabled for 5G. £22 for 20GB, and £25 for 40GB. 5G then quietly disappeared from BT Mobile offers. Voxi added 5G availability to its £15 and £20 mid-tier pre-pay bundles, 5G previously available only on its £35 unlimited data plan.

- EE and BT changed annual price increase policy. Pay-monthly terms and conditions were updated to reflect an annual price rise of “CPI + 3.9%”. Previously EE’s annual price rise was linked to RPI, and BT’s to CPI, inflation increases.

- EE introduced Full Works for iPhone sim-only plans. This cost £41 per month, on a 24-month term with uncapped, unlimited 5G data plus a bundle of three Apple entertainment services covering music, TV and games. Also during September, EE switched its more extensive range of premium smart sim plans from 18-months to 24-months. Smart sim plans offer a choice of entertainment streaming services such as BT Sport, BritBox and Amazon Prime Video.

Subsegment Participation

Let’s review the map of which brands play in each subsegment of the sim-only phone market.

Q3 2020 Subsegment participation by brand

The key developments in participation during Q3 2020 quarter were:

- July: Tesco withdraws from the 24-Month PAYM subsegment.

- September: EE withdraws from the 18-month PAYM subsegment, replaced by Tesco who enters the 18-Month subsegment.

Turning now to plan distribution by subsegment.

Q3 2020 Phone sim-only plan distribution by subsegment:

- 30-Day Prepay: ➡️ 25.0% (vs 25.7% Q2 2020, -0.7 pp)

- 30-Day PAYM: ⬇️ 18.5% (vs 20.6% Q2 2020, -2.1 pp)

- 12-Month PAYM: ⬇️ 31.0% (vs 33.1% Q2 2020, -2.2 pp)

- 18-Month PAYM: ⬆️ 9.8% (vs 7.4% Q2 2020, +2.4 pp)

- 24-Month PAYM: ⬆️ 15.8% (vs 13.1% Q2 2020, +2.6 pp)

- 12-Months+ share of dataset plans: ⬆️ 56.5% (vs 53.7% Q2 2020, +2.8 pp)

- 18-Months+ share of dataset plans: ⬆️ 25.5% (vs 20.6% Q2 2020, +5.0 pp)

- Weighted average contract term of dataset plans: ⬆️ 9.7 months (vs 8.9 months in Q2 2020, +0.8 months, +8.6%).

In our Q2 2020 review, we noted that plans with contract durations of 12-months and longer were now the majority of dataset plans. This trend continues into Q3 2020, where 53.7% of dataset plans require 12-month commitment or longer.

In Q3 2020, we can see plans with contract length 18-months and longer now compromise over 25% of the dataset, jumping 5 percentage points from Q2 2020.

The continued push from operators to increase the length of contract commitments in their offerings sees the weighted average contract term of dataset plans hit 9.7 months, an increase in 0.8 months versus Q2 2020.

24-Month plans were the fastest growing subsegment of the dataset in Q3 2020, increasing to 15.8% of the dataset in Q3 2020, up 2.6 pp from Q2 2020. For comparison, 24-Month plans comprised only 4.7% of the dataset in Q4 2019.

Let’s turn to average plan price per subsegment.

Q3 2020 Phone sim-only average plan price by subsegment:

- 30-Day Prepay: ⬇️ £16.87 (vs £17.31 Q2 2020, -2.6%)

- 30-Day PAYM: ⬆️ £19.29 (vs £18.44 Q2 2020, +4.6%)

- 12-Month PAYM:⬇️ £18.50 (vs £19.12 Q2 2020, -3.2%)

- 18-Month PAYM: ⬇️ £15.83 (vs £20.77 Q2 2020, -23.8%)

- 24-Month PAYM: ⬆️ £21.85 (vs £20.08 Q2 2020, +8.9%)

- Average across all plans: ⬇️ £18.51 (vs £18.76 Q2 2020, -1.4%)

Average plan prices per subsegment of the dataset declined, with the exception of the 30-Day and 24-month PAYM subsegments (price increases of 4.6% QoQ and 8.9% QoQ respectively). The 30-Day PAYM price increase was predominantly driven by Vodafone increasing pricing on its 20GB and unlimited 30-Day 5G plans over this period.

The average plan price of the 18-Month subsegment shrunk 23.8% to £15.83, as EE and it’s higher priced plans exited the 18-month subsegment, replaced by Tesco with lower pricing.

Let’s looks at plan distribution by data allowance.

Q3 2020 Phone sim-only plan distribution by data allowance:

- 1GB – <2GB: ➡️ 6.0% (vs 6.3% Q2 2020, -0.3 pp)

- 2GB – <5GB: ➡️ 14.7% (vs 14.9% Q2 2020, -0.2 pp)

- 5GB – <10GB: ➡️ 15.2% (vs 16.0% Q2 2020, -0.8 pp)

- 10GB – <20GB: ⬆️ 14.7% (vs 13.1% Q2 2020, +1.5 pp)

- 20GB – <50GB:⬆️ 20.1% (vs 18.9% Q2 2020, +1.3 pp)

- 50GB – <100GB: ⬇️ 4.9% (vs 7.4% Q2 2020, -2.5 pp)

- 100GB – < Unlimited GB: ➡️ 8.2% (vs 8.6% Q2 2020, -0.4 pp)

- Unlimited GB: ⬆️ 16.3% (vs 14.9% Q2 2020, +1.4 pp)

- Plans 50GB+: ⬇️ 29.3% (vs 30.9% Q2 2020, -1.5 pp)

The key takeaway here is that data allowance growth, as measured by the proportion of dataset plans offering 50GB+, declined 1.5 percentage points to 29.3% versus Q2 2020. We are expecting to see plan data allowances increase as 5G plans grow their presence in the market, but we are not seeing evidence of this change yet.

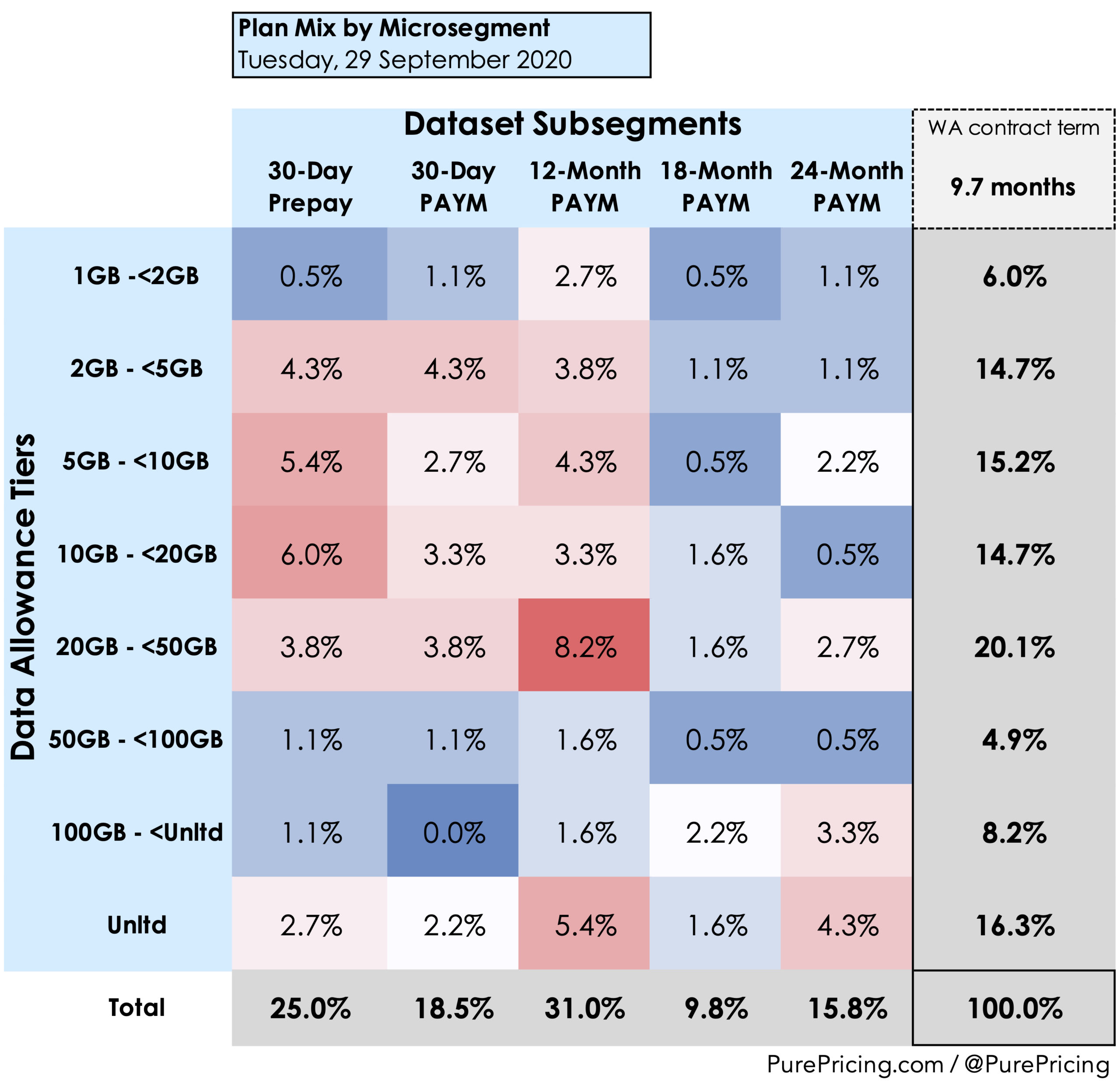

Another useful way to examine the market is to combine the contract length subsegments with the data allowance bands to produce a heat map of the the 40 microsegments in the dataset.

Q3 2020 Phone sim-only plan microsegment heat map

12-Month PAYM plans with 20-50 GB data allowance remain the “hotspot” in the dataset, capturing 8.2% of all dataset plans. 12-Month PAYM is the most popular subsegment at 31.0% of dataset plans, while 20GB-49GB remains the most offered data allowance tier at 20.1% of the dataset.

Turning now to operator targeting of the 40 microsegments, we can examine a table of the lowest price brand(s) per microsegment. This view provides insight as to which microsegments each operator brand is focusing its competitive efforts.

Q3 2020 Phone sim-only lowest priced plan per data allowance tier and subsegment

Examining each of the subsegments in turn:

Q3 2020 Phone sim-only 30-day prepay lowest priced plan

Three continues to deploy its SMARTY sub-brand as a pre-pay price leader. In June SMARTY cut the price of its unlimited data bundle to £18 from £20, but reversed this price change in August without losing its position as lowest priced brand for unlimited prepaid data. It is noteworthy that SMARTY’s 30-day offerings for the 20GB+, 50GB+ and 100GB+ allowance bands are all the lowest price in the dataset for these categories, regardless of contract duration. From this perspective, SMARTY’s pricing can be seen to be very aggressive.

Q3 2020 Phone sim-only 30-day pay-monthly lowest priced plan

iD Mobile continues its focus on retaining its spot as the lowest priced brand in this subsegment. In September it dropped the price of its unlimited data plan to £18 (was £20). The £18 price-point places this plan as the lowest priced unlimited data plan across all contract length subsegments. Further, it represents a 28% decline in pricing from the £25 price-point iD set for this plan at the start of the year.

Q3 2020 Phone sim-only 12-month pay-monthly lowest priced plan

Three made the strongest pricing moves in the 12-Month subsegment during Q3 2020. It ran a ‘6 months half price’ promotion on its unlimited data plan from late July onwards. This had the effect of dropping the average monthly price of the plan below £20.

Q3 2020 Phone sim-only 18-month pay-monthly lowest priced plan

Tesco’s entry into the 18-Month subsegment secured it the lowest priced brand for the 5GB+ and 10GB+ data tiers. Meanwhile BT reduced pricing on its 50GB plan for its broadband customers (100GB for Halo customers) to £15 from £20. Overall, BT remains dominant in the 18-month subsegment on a lowest price plan basis.

Q3 2020 Phone sim-only 24-month pay-monthly lowest priced plan

Three continues its battle with Virgin to secure the mantle of the lowest priced brand in the 24-Month subsegment. This quarter Three reduced pricing for its entry level 1GB+ and 5GB+ data allowances, and continued promotional pricing on its unlimited data plan to keep average monthly pricing below £20.

Concluding Takeaways from Q3 2020

- 184 eligible sim-only plans offered by 13 MNO / MVNO brands tracked in dataset as at 29 September 2020.

- Sim-only plans requiring contract commitment of 12-months or longer comprise over half (53.7%) of all dataset plans. Plans with commitments of 18-months or longer now comprise over a quarter (25.5%) of dataset plans.

- Weighted average contract term of dataset plans grows to 9.7 months (+8.6% QoQ).

- Average plan price records slight decline to £18.51 per month (-1.4% QoQ).

- Data allowance growth down slightly, with 29.3% of dataset plans offering 50GB+ data allowances (versus 30.9% in Q2 2020, -1.6 pp).

- 12-Month PAYM plans offering 20-49GB remain the dataset hotspot, capturing 8.2% of plans on offer.

- 12-Month PAYM remains the largest subsegment at 31.0% of the dataset. 20-49GB remains the most offered allowance tier, at 20.1% of dataset plans.

- Tesco Mobile exited the 24-month subsegment in July, and entered the 18-month subsegment in September. Also in September, EE withdrew from the 18-month subsegment.

For questions or follow-up, you can reach us at at hello@purepricing or via Twitter @PurePricing

Appendix (Tracking Methodology):

Each week Pure Pricing collects sim-only plan data for the following operators:

BT (plans available to broadband customers), BT (plans available to Halo customers), Plusnet (plans available to broadband customers), EE, iD, O2, giffgaff, Tesco Mobile, Sky, Three, SMARTY, Virgin, Vodafone and VOXI. Standalone SIMO plans from BT and Plusnet that don’t require customers to already have a broadband service from these operators have been excluded. Only plans with monthly data allowances of at least 1GB of data are included in the market study. Vodafone unlimited plans with speed restrictions of 2Mbps are excluded.

Pure Pricing’s sim-only dataset tracks plans offered for sale by operators, not plans purchased by customers.

QoQ percentage changes are marked as ➡️ flat unless QoQ movement is ≥1 percentage point (pp) positive or negative.

Additional BT notes:

- BT (+BB) = Phone sim-only plans available to standard BT broadband customers

- BT (+Halo BB) = Phone sim-only plans available to BT “Halo” premium converged broadband customers

- BT (EE) = Phone sim-only plans offered by BT’s EE brand

- BT (Plusnet +BB) = Plusnet brand phone sim-only plans available to Plusnet broadband customers

Terminology:

- Subsegment refers to contract length segments of the market, i.e. 30-day prepay, 30-day PAYM, 12-month PAYM, 18-month PAYM, 24-month PAYM.

- Data tiers refer to the segmentation of data allowance used in the dataset (1GB+, 2GB+, 5GB+, 10GB+, 20GB+, 50GB+, 100GB+, unlimited data).

- Microsegment refers to a combination of a subsegment and data tier, e.g. 30-day PAYM plans offering 50GB – <100GB.