In this piece, we are reviewing the pricing strategy behind EE’s Full Works for iPhone plan, launched September 2020. We want to examine why EE launched this plan, how it is performing, and what lessons can be applied to other elements of operator pricing.

Winning and retaining iPhone customers remains a strong focus for operators. iPhone customers tend to have predictable, desirable behaviours. They will upgrade, at some point, to another iPhone, and demonstrate a willingness to pay more for a better experience.

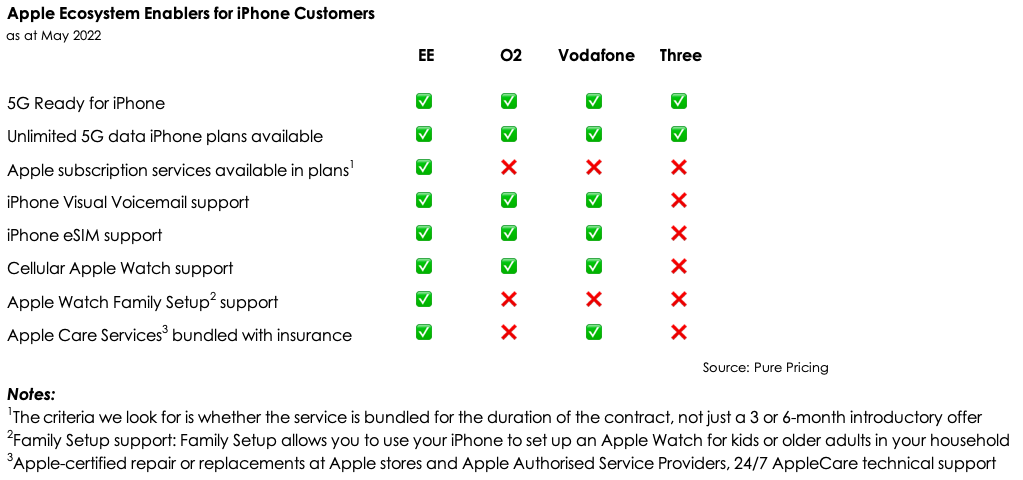

Over recent years EE has pushed to position itself as the most iPhone friendly mobile network amongst the four MNOs. Aside from its UK network 5G leadership claims, EE has built out a full checklist of iPhone ecosystem enablers to assist iPhone customers get the best iPhone experience by choosing EE.

When launching Full Works for iPhone plan in late 2020. EE stated its aim for the plan was to offer “the best of EE and the best of Apple on one mobile plan”.

The target market for the plan was engaged iPhone customers wanting a deeper Apple and iPhone experience beyond a phone and data plan. Full Works for iPhone plan offered customers:

- Unlimited EE data: Uncapped 4G and 5G access

- Upgrade anytime: Option for a customer to upgrade to a new iPhone anytime they want

- Lifetime guarantee: An extended phone warranty for the lifetime of their contract until they upgrade or leave

- Apple Music: Inclusive Apple Music for the duration of the plan (£9.99 per month value)

- Apple TV+: Inclusive Apple TV+ for the duration of the plan (£4.99 per month value)

- Apple Arcade: Inclusive Apple Arcade for the duration of the plan (£4.99 per month value)

EE names inclusive services such as Apple Music as “Smart Benefits”. Customers could choose to swap out one or more of the three Smart Benefits above for a non-Apple Smart Benefit, such as BT Sport.

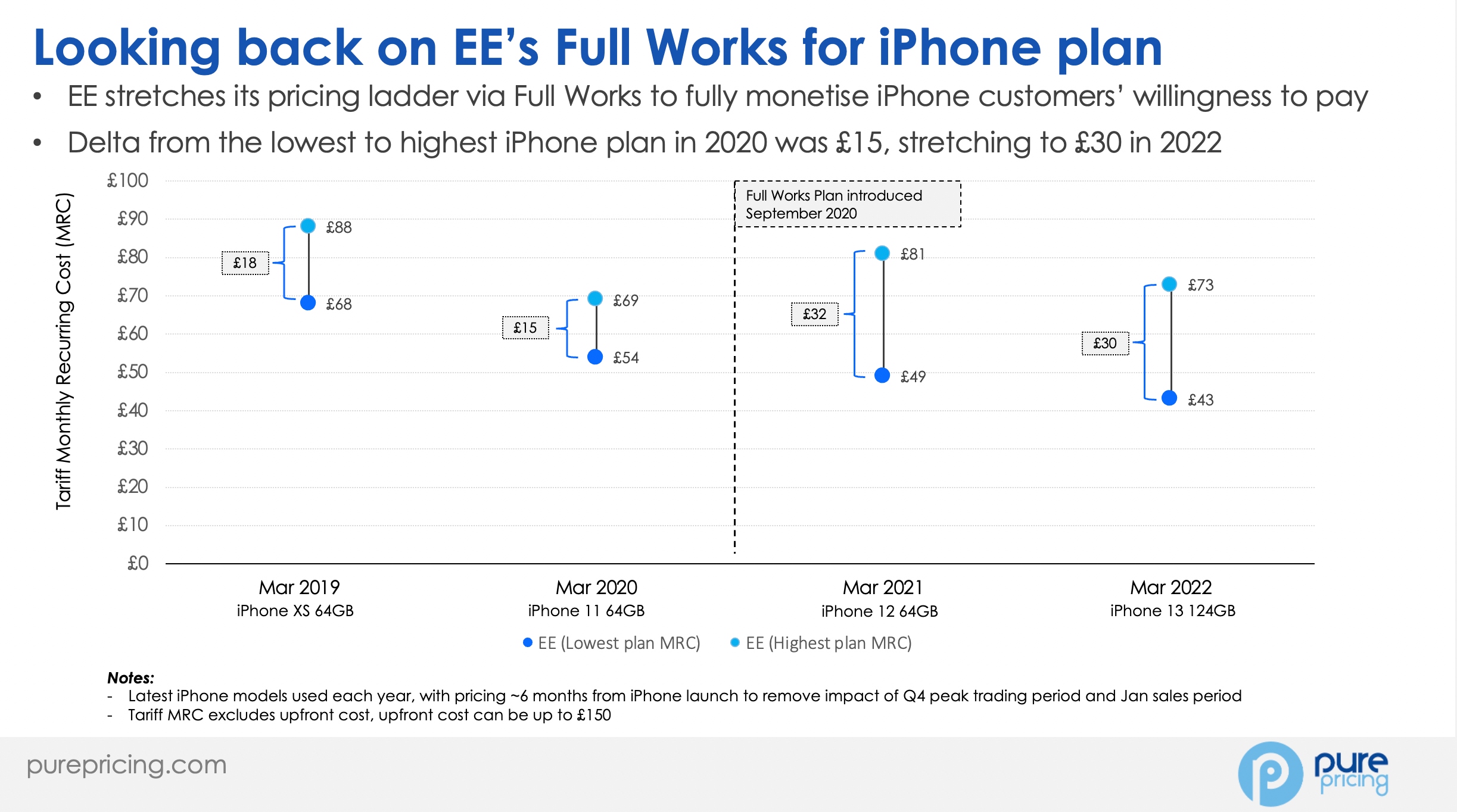

EE’s pricing intent for Full Works for iPhone was to stretch the tariff ladder between EE’s lowest and highest priced plan for each iPhone model. EE offers an entry level plan of iPhone and a low data allowance, and then stretches the range up to the Full Works premium iPhone plan. The most engaged iPhone customers, attracted to this plan would pay EE a premium for a richer Apple ecosystem experience via EE.

Full Works for iPhone also reflects Apple’s own iPhone pricing strategy. Apple makes the entry level annual iPhone model as affordable as possible, then stretches the pricing ladder to create new, higher price points for customers seeking the most premium iPhone experience.

To demonstrate, we can review Apple’s iPhone pricing for its annual iPhone model and compare the gap between the entry model and the most premium model.

- 2019:

- Entry model iPhone 11 64GB: £729,

- Premium model iPhone 11 Pro Max 512GB: £1499

- Price ladder gap: £770

- 2020:

- Entry model iPhone 12 64GB: £799,

- Premium model iPhone 12 Pro Max 512GB: £1399

- Price ladder gap: £600

- 2021:

- Entry model iPhone 13 128GB: £779,

- Premium model iPhone 13 Pro Max 1TB: £1549

- Price ladder gap: £770

In EE’s case, Full Works for iPhone is used to stretch pricing from an entry level 1-2GB price plan to price-points beyond what EE could command by offering unlimited data only. The inclusion of Apple subscription services within the Full Works package stretches the price ladder up to new, higher price points.

Thanks to Full Works for iPhone, EE has been able to double the price ladder gap between its lowest and highest iPhone plans from £15 per month in 2020 for the iPhone 11, to £30 in 2022 for the iPhone 13.

Vodafone attempts a similar strategy with its Entertainment plans; however, we see Full Works for iPhone as a stronger proposition as it is better focused on addressing the specific needs of premium iPhone customers. Vodafone chooses a blunter approach of bundling Netflix or YouTube Premium in with higher allowance plans for iPhone or Android customers.

The broader lesson for operators is to build focused premium experiences that can command premium prices. We see further examples of this approach in BT’s Halo broadband pricing strategy, which will be reviewed in a future post.