Virgin Media O2’s (VMO2) Volt proposition makes a big impact from a simple idea. If you want people to do something, you’ve got to step forward and ask them to do it.

VMO2 uses Volt to ask Virgin Media broadband customers to take O2 Pay monthly mobile, and O2 Pay monthly customers to take Virgin Media broadband.

In return, VMO2 offers its customers a clearly defined set of benefits as a reward for combining fixed and mobile VMO2 services via Volt. There are:

Fixed broadband rewards:

- Free upgrade to next speed tier

- Free WiFi extender pods to improve home WiFi coverage

Pay monthly mobile rewards:

- Double data on every eligible Pay monthly sim

- Inclusive roaming in 75 countries in EU and beyond for every eligible sims

- Up to £150 off an O2 plan for a connected device

The VMO2 customer ask is clear and impactful. Customers who act to combine fixed and mobile services get upgraded plans and gifted services.

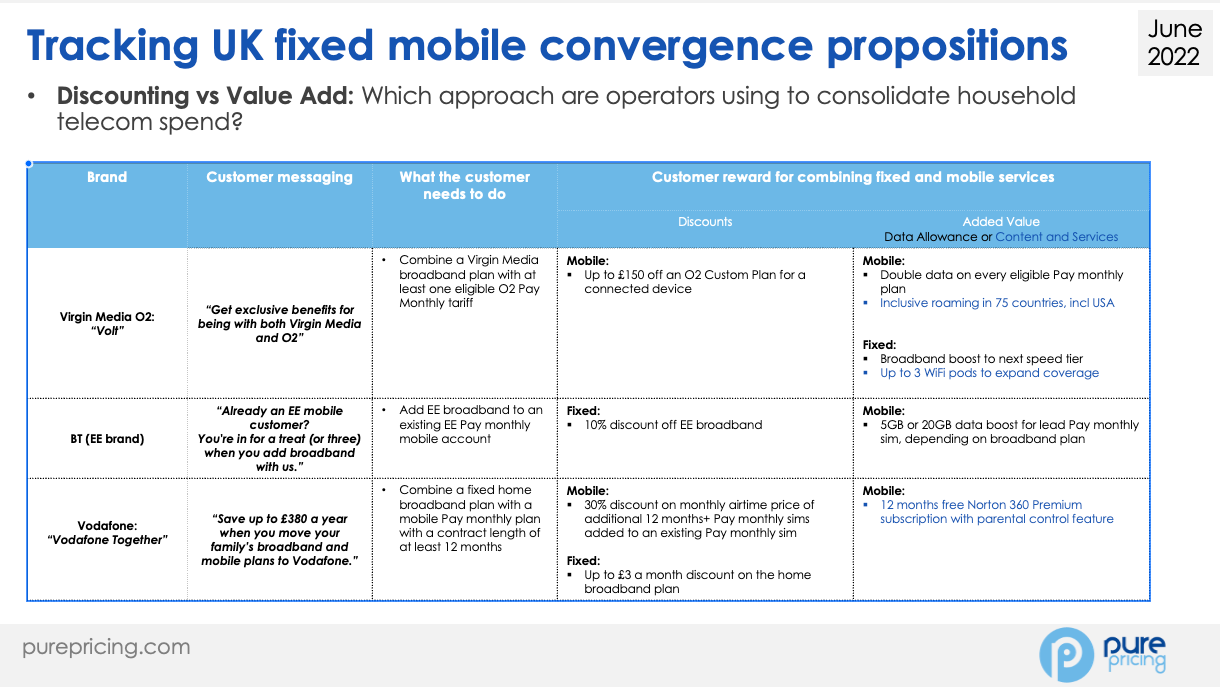

The marketing approach contrasts with VMO2 competitors, who are primarily attempting to drive convergence via price discounting and savings messaging.

Examining competitors BT/ EE, Sky and Vodafone, Vodafone has the most defined fixed mobile convergence proposition, Vodafone Together.

Vodafone Together seeks to win converged customers via savings from price discounting rather than added value. Vodafone customers who combine fixed and mobile plans via Vodafone Together receive the following discounts.

Fixed broadband discounts:

- Up to £3 a month discount on a fixed broadband plan

Pay monthly mobile discounts:

- 30% discount on additional airtime plans added to an existing Pay monthly plan

Vodafone messages Vodafone Together by claiming customers can “save up to £380 a year” by moving a family’s broadband and mobile plans to Vodafone. The £380 saving claim is evidenced by showing the combined impact of Vodafone Together discounts applied to a broadband plan and four sim-only plans, as compared to Vodafone’s non-discounted prices.

Arguably this leaves a new or existing Vodafone customer to fumble on their own in trying to calculate exactly what savings – if any – they could make on Vodafone Together versus their existing plans. The discount elements are also potentially confusing for customers to balance – is 30% off an additional airtime plan more or less valuable than £3 off a broadband plan?

Out of the two convergence incentive approaches: value-add vs discounting, we see VMO2’s proposition to be stronger from a marketing perspective. Customers can immediately see the value unlocked by convergence, via the free plan upgrades and additional extras mechanic. Commercially VMO2’s value-add approach is stronger than plan discounting, as converged ARPA (Average Revenue Per Account) is not diluted by price discounting.

Volt’s value-add mechanic allows plenty of headroom to grow the proposition over time, for example by adding free streaming content which is unlocked on specific Volt plans.

That said, the Volt proposition leaves significant room for improvement. Billing and account management is done separately by each brand, so Volt customers receive two bills and two account management processes. Volt lacks strong incentives encouraging households to consolidate all mobile lines under one account. The proposition is clearly in its early stages – baby steps for VMO2’s convergence ambitions.

Still, we see VMO2’s value-add approach to Volt benefits as being on the right track to accelerate convergence. Ask the customer to consider a converged account, then show them the added value they’ll receive if they act.