Background: Each quarter we’re going leverage Pure Pricing’s datasets to look back and analyse how the UK phone sim-only market is evolving over time. We’ll review the market forces which impacted the decisions of the operators that compete within the phone sim-only market.

This review will look at calendar Q1 2020 with market data as at Tuesday, 31st March 2020.

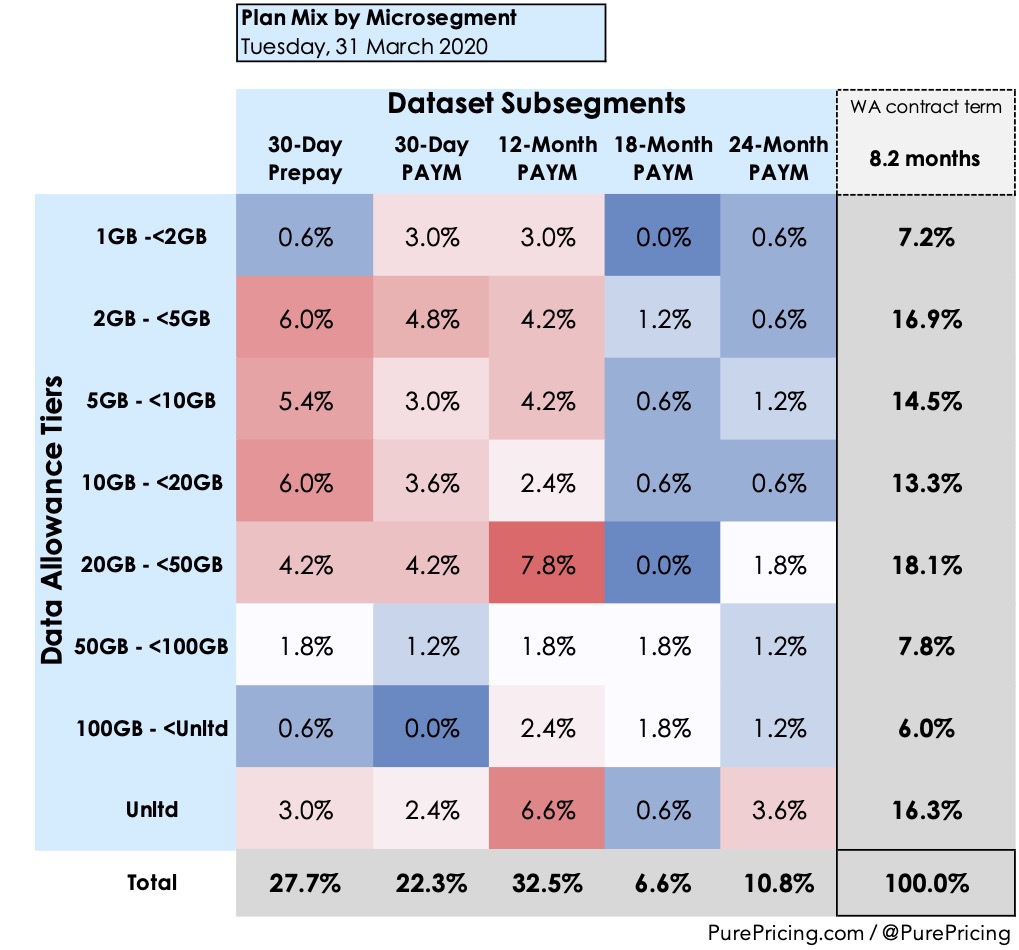

We have 166 phone sim-only plans tracked in the study as at 31 March 2020. These are split amongst 5 market subsegments (30-Day Prepay, 30-Day PAYM, 12-Month PAYM etc) and 8 data tiers (e.g. 2GB+, 5GB+, 10GB+), producing a map of 40 microsegments in which price plans compete.

Please note: The study tracks the mix of plans offered from operators, not the actual or estimated mix of plans purchased by customers.

Our market plan microsegment analysis seeks to answer the questions:

- How do microsegments change over time as competition evolves?

- Which microsegments do operators target?

For detailed information on our tracking methodology, please see the note at the end of the post.

Let’s get started by looking at market plan distribution by subsegment.

Q1 2020 Phone sim-only plan distribution by market subsegment:

- 30-Day Prepay: ⬇️ 27.7% (vs 29.0% Q4 2019, -1.3%)

- 30-Day PAYM: ➡️ 22.3% (vs 22.5% Q4 2019, -0.2%)

- 12-Month PAYM: ⬇️ 32.5% (vs 36.7% Q4 2019, -4.2%)

- 18-Month PAYM: ➡️ 6.6% (vs 7.1% Q4 2019, -0.5%)

- 24-Month PAYM: ⬆️ 10.8% (vs 4.7% Q4 2019, +6.1%)

- Weighted average contract term of market plans: ⬆️ 8.2 months (vs 7.3 months in Q4 2019, +0.9 months).

The standout development here is the 24 Month PAYM subsegment, more than doubling its share of market plans to 10.8%. In December 2019, only Three and EE offered 24 Month PAYM phone sim-only plans. During Q1, Tesco (January) and Vodafone (February) joined this subsegment with new plan launches. The growth of the 24 Month PAYM segment contributed to an increase in the overall weighted average contract term of market plans by 0.9 months.

Let’s turn to average plan price per market subsegment.

- 30-Day Prepay: ⬇️ £17.30 (vs £18.28 Q4 2019, -5.3%)

- 30-Day PAYM: ⬇️ £18.41 (vs £18.76 Q4 2019, -1.9%)

- 12-Month PAYM:⬇️ £19.44 (vs £20.83 Q4 2019, -6.7%)

- 18-Month PAYM: ⬇️ £20.82 (vs £22.83 Q4 2019, -8.8%)

- 24-Month PAYM: ⬆️ £21.49 (vs £17.94 Q4 2019, +19.8%)

- Average across all plans: ⬇️ £18.93 (vs £19.63 Q4 2019, -3.6%)

Average plan prices per subsegment show an increase as contract term lengthen. For example, the lowest commitment subsegment (30-Day Prepay) shows an average plan price of £17.30, as compared to the highest commitment subsegment (24-Month PAYM) of £21.49. Operators are using larger data allowances and other incentives such as bundled streaming content to lure customers to trade up to plans with higher prices and longer contract terms.

The 18 Month PAYM subsegment saw the largest price decline (-8.8%). O2 and EE are the only two brands playing in this small subsegment, and large price decreases suggest customers need additional price incentives to choose 18 month plans over 12 month alternatives.

The 24 Month PAYM subsegment average price jump (+19.8%) was driven by Vodafone’s entry into the 24 Month PAYM subsegment. Vodafone entered the 24-Month subsegment with a plan price averaging £23.78 as at 31 March 2020.

The 24 Month PAYM subsegment also provides an incentive for operators to set their headline prices relatively high, with the knowledge that pricing can be discounted with 6 month half-price promotions at a later date to drive trading messages.

Let’s looks at plan distribution by data allowance.

Q1 2020 Phone sim-only plan distribution by data allowance:

- 1GB – <2GB: ➡️ 7.2% (vs 7.7% Q4 2019, -0.5%)

- 2GB – <5GB: ➡️ 16.9% (vs 17.2% Q4 2019, -0.3%)

- 5GB – <10GB: ➡️ 14.5% (vs 14.2% Q4 2019, +0.3%)

- 10GB – <20GB: ➡️ 13.3% (vs 14.2% Q4 2019, -0.9%)

- 20GB – <50GB: ⬇️ 18.1% (vs 22.5% Q4 2019, -4.4%)

- 50GB – <100GB: ⬆️ 7.8% (vs 4.7% Q4 2019, +3.1%)

- 100GB – < Unlimited GB: ⬆️ 6.0% (vs 3.6% Q4 2019, +2.5%)

- Unlimited GB: ➡️ 16.3% (vs 16.0% Q4 2019, +0.3%)

- Plans 50GB+: ⬆️ 30.1% (vs 24.3% Q4 2019, +5.9%)

The key takeaway here is the growth in allowance that has accompanied the increase in weighted average contract term. 30.1% of market plans in Q1 2020 contained 50GB+, compared with 24.3% in Q4 2019. Customers are receiving larger data allowances in their plans, but in return are committing to longer contract terms.

Another useful way to look at the market is to combine the contract length subsegments with the data allowance bands to produce a heat map of the the 40 microsegments as follows.

12-Month PAYM plans with 20-50 GB data allowance is the “hotspot” in the market, capturing 7.8% of all plans on offer.

Turning now to operator targeting of the 40 microsegments, we can view a table of the lowest price brand(s) per microsegment to gain insight as to which microsegments each operator brand is focusing its competitive efforts.

Examining each of the subsegments in turn:

- 30-Day Prepay: Three is deploying its SMARTY sub-brand to drive acquisition in this subsegment. By underpricing its competitors giffgaff and VOXI, Three positions SMARTY to build a prepay base for driving upsell to the main Three pay-monthly base.

- 30-Day PAYM: iD Mobile sees this segment as its main hunting ground for connections. It prices aggressively to ensure it offers strong value across the data allowance bands. BT also uses the subsegment to drive mobile cross sell for its broadband value brand Plusnet.

- 12-Month PAYM: This subsegment is a messy battleground, with the largest number of plans (32.5% of market) jostling for customer attention. BT are increasingly using it as a cross-sell opportunity for its BT brand broadband customers. It is particularly aggressive on pricing for its ‘Halo’ premium converged proposition customers. These customers are offered additional data value (e.g. double data) on BT branded mobile plans.

- 18-Month PAYM: This subsegment is the smallest number of plans (6.6% of market). O2, and increasingly EE, use the segment to tempt customers looking at its 12-Month PAYM plans with additional value in return for extended commitment.

- 24-Month PAYM: Three have traditionally dominated this subsegment on price, however Tesco Mobile are becoming more aggressive. To drive trading shouts, Three will often apply “half price for 3 months” or “half price for 6 months” promotions.

Key findings of Q1 2020 Phone Sim-Only Review

- Longer contract terms: The market saw an Increase in the weighted average contract term of phone sim-only plans of 0.9 months. This was driven by growth in the 24-Month PAYM subsegment as Tesco (January) and Vodafone (February) joined the subsegment. The 24-Month PAYM subsegment more than doubled its share of market plans to 10.8% from 4.7%.

- Pricing swings in 18 and 24-month subsegments: The 18 Month PAYM subsegment saw the largest price decline (-8.8%). O2 and EE are the only two brands playing in this small subsegment, and large price decreases suggest customers seek additional price incentives to consider these plans. Meanwhile, the 24-Month PAYM subsegment average price jumped +19.8%. Vodafone’s entry into the 24-Month PAYM subsegment was a major driver, with Vodafone’s plan price averaging £23.78 for this subsegment, raising the overall average price to £21.49.

- Increased focus on 18 and 24-Month PAYM subsegments: With BT becoming more aggressive on pricing in the 12-Month PAYM subsegment for its BT broadband customers, O2 and EE seek to grow the 18 Month subsegment. Thee is aggressively pricing in the 24-Month subsegment, but Tesco Mobile also sees growth opportunities in this subsegment.

Tracking methodology:

- Each week Pure Pricing collects sim-only plan data for the following operators:

- BT (plans available to broadband customers), BT (plans available to Halo customers), Plusnet (plans available to broadband customers), EE, iD, O2, giffgaff, Tesco Mobile, Sky, Three, SMARTY, Virgin, Vodafone and VOXI. Standalone SIMO plans from BT and Plusnet that don’t require customers to already have a broadband service from these operators have been excluded. Only plans with monthly data allowances of at least 1GB of data are included in the market study. Vodafone unlimited plans with speed restrictions of less than 2Mbps are excluded.

- Additional BT notes:

- BT (+BB) = Phone sim-only plans available to standard BT broadband customers

- BT (+Halo BB) = Phone sim-only plans available to BT “Halo” premium broadband customers

- BT (EE) = Phone sim-only plans offered by BT’s EE brand

- BT (Plusnet +BB) = Plusnet brand phone sim-only plans available to Plusnet brand broadband customers

- Voice centric phone sim-only plans of less than 1GB allowance are excluded from the data set.

- QoQ percentage changes are marked as ➡️ flat unless QoQ movement is ≥1 percentage point + or -)